Much more and much more loan companies, employers, landlords and insurance coverage companies are checking your FICO score as part of their procedure of approving your mortgage, landing a career, having your own house to reside, or good prices given for any type of insurance that you may have applied for. To attain all of these things which you are dreaming of accomplishing building a good check my credit score history will be the initial factor which you have to do if in case you acquired 1 with a poor history.

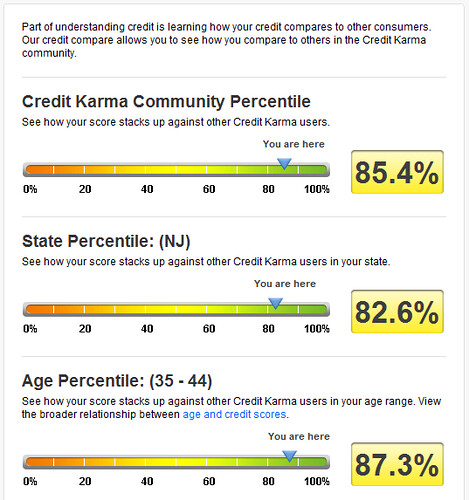

Credit scores start from the reduced 300 towards the cream of the crop 850. A regular consumer has a credit range of 600 to 700 but some may have much more than this. A FICO score is the basis of most lenders and credit bureaus of computing your creditworthiness. A great credit score score falls on an average of 720 and over. Where does 1 obtain the info on their respective credit scores? By law this really is given for free once a yr coming in the three major credit bureaus: Equifax, Experian and TransUnion. Your scores and credit score background shows your current and closed accounts also as your payment history.

Lenders do generally have a look on your check my credit score history as the basis on whether or not they'll grant your mortgage at a good rate of interest or deny this completely. If correct now you are interested on applying to get a mortgage that necessitates a high credit score score then it could be very best to use for FICO score monitoring which usually gives you an update in your scores on a weekly foundation. Subscribing to this online support alerts you whenever you have reach your high score objective as long as you setup a threshold for it. Some would go as far as sending you an sms to alert you when your scores have change for the much better or for the worst.

To help you build a much better credit score and history listed here are some simple guidelines to adhere to:

Request a duplicate of your credit history as required if not wait for it as soon as a yr but do monitor your background for just about any mistakes. In the event you see discrepancies then you are able to dispute them by going through your reports thoroughly.

Pay your bills promptly. Add some more around the minimal amount which you usually pay because this would cause your credit score to rise and could be obvious for most loan companies which you are a good borrower because you pay promptly and is sincere in settling your expenses.Avoid maxing out in your credit limit. This may certainly cause your credit scores to drop that fast. Cancel credit cards that you aren't using or do not need and spend on time for your credit card bills.

No comments:

Post a Comment